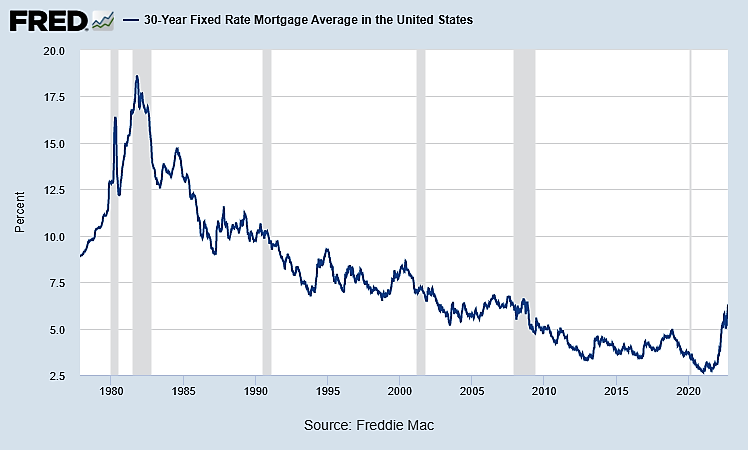

Mortgage Interest Rates constantly change within the financial markets, and the rate quoted may change multiple times during the day. The above graph shows mortgage interest rates from 1978 to today. The current rates have increased since the post-pandemic period, and although they may be perceived as high, rates are in line with the overall mortgage interest rates dating back to 2005. Additionally, before 2005, mortgage interest rates were higher than today’s rates.

Interest rates are quoted upon request on a specific date, for example, upon completion of your prequalification or as you shop for a home. Since rates are constantly changing, the rate at the time of PreQualification may differ from the rate quoted after you signed your sales agreement. Your interest rate can be “locked” when you and the seller have signed the sales agreement for a particular home, the closing date is determined, and you are ready to begin your loan application.

Many factors are involved in determining your mortgage interest rate based on current financial market conditions and the risk to the lender. Some items that may affect your mortgage interest rate quote are listed below:

- Type of Loan – Each loan type, such as Conventional, FHA, VA, or USDA-RD loans, is priced individually so the daily rate quote will differ for each type of loan.

- Term of Loan – Choosing a 30, 20, 15, or 10-year period will affect your interest rate. Typically shorter-term loans offer slightly lower interest rates.

- Credit Scores – Credit scores affect the interest rate calculation. Your credit scores are more likely to affect your interest rate for conventional loans than FHA, VA, or USDA-RD.

- Down Payment – The percentage of your down payment is factored into your rate calculation—the greater the down payment, the lower the risk to the lender.

- The number of days to Closing – The rate quoted differs depending on the number of days to closing: 30 days, 45 days, etc. The shorter the period to close, the better the interest rate quote.

- Occupancy – Whether the home is your primary residence or investment property will also affect the mortgage rate quoted.

“Discount Points” (calculated as 1% of the loan amount = 1 “point”) are interest paid to the lender to lower your rate over the life of the loan. A lower rate would decrease your monthly payment, so paying points may benefit you. We will review all available options when it is time to lock your rate and help you make a wise decision.